Stretch IRA

Strategy for the Future

A Stretch IRA is a wealth-transfer strategy that allows you to extend the period of tax-deferred earnings on the assets of a pre-existing, or newly established IRA by passing your IRA assets to a younger beneficiary. This allows the money that would have been paid in taxes to work for your heirs, instead of Uncle Sam.

An article in Business Week, states an IRA beneficiary lost over 90% of his IRA due to immediate taxation. This could have been avoided had a proactive advisor been consulted.

Under IRS regulations issued in 2002, any individual who holds a traditional IRA can change the beneficiary to “stretch” IRA distributions. If you do not need to live on your IRA assets and want to benefit younger generations, consider using the Stretch IRA strategy.

Safe & Secure

Provides tax-efficient wealth transfer

- The law requires that once you reach age 70½, you must withdraw a required amount from your traditional IRA each year (RMD). When you choose to withdraw no more than those required distributions from your IRA and designate a younger beneficiary, you can extend the life of your IRA.

- Under the new IRS regulations, if you have an individual designated beneficiary, your beneficiary will not be required to completely withdraw your IRA assets either within five years of your death or over your remaining life expectancy. When a younger beneficiary inherits an IRA, the remaining balance can be paid out over the younger person’s single life expectancy, effectively stretching out the length of time that withdrawals can be taken from that IRA. This extends the period of tax-deferred earnings of assets within an IRA beyond the lifetime of the person who set up the IRA.

- Payments to beneficiaries are paid out as income (RMD), which may not be subject to the 10% penalty tax even for a beneficiary under age 59½.

Retain control of the IRA

- Most of the Stretch IRA planning is revocable until death. So, for example, if your financial situation changes and you need more income in retirement, you can take larger IRA distributions as needed. However, once you reach age 70½, you can’t request a smaller amount than your required minimum distributions.

- Similarly, if the beneficiary’s situation changes after the death of the owner, he or she may take distributions exceeding the required minimum distributions.

- You can change your beneficiary at any time until death. In most cases, such a change would not affect the amount of required minimum distributions during your lifetime.

- It is important to know that you can only do a “Stretch IRA” if you have a willing custodian. If you do not know whether you have a “Stretch IRA” or not, you may want to consider a new advisor.

Request a Stretch IRA Proposal

If you would like to receive a Stretch IRA Proposal,

email or give us a call at (423) 710-2865.

Resources for Your Benefit

Below are links to some resources for your benefit.

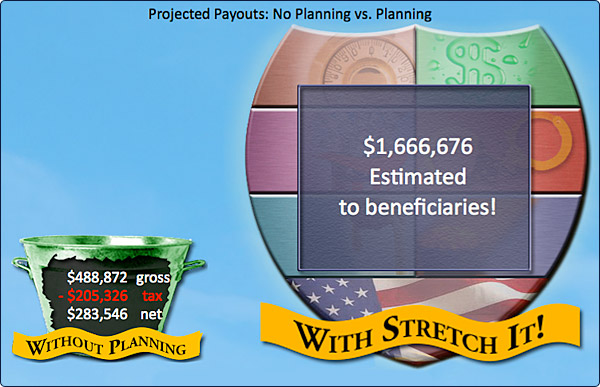

EXAMPLE

Original IRA $250,000 Net to Heirs – Outcome Comparison

Hypothetical Example

Hypothetical Example

- Loss of tax deferral

- Lump sum of income tax

- Maintain tax deferral

- Provide a lifetime of income for children and grandchildren

- Provides a Legacy for Grandparents

Numbers based on married couple of 65 and 64 with 1 beneficiary.